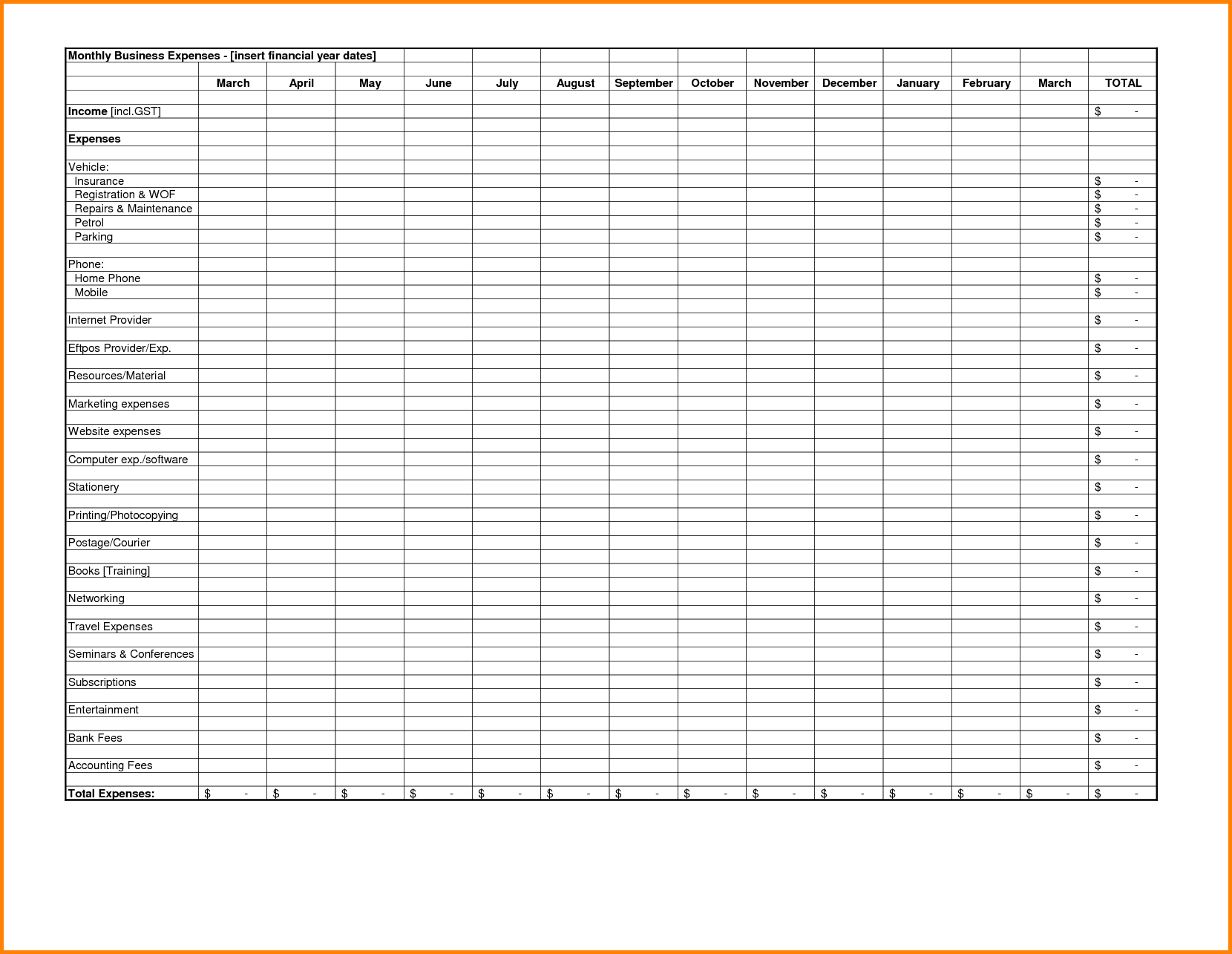

THE SPREADSHEET WILL WORK ON THE DESKTOP VERSION OF MICROSOFT EXCEL ON BOTH A WINDOWS PC AND A MAC If your annual business turnover is less than the VAT threshold for the tax year then when completing your self-assessment tax return you can use the supplementary form SA103S(short) to record self-employment income on your SA100 tax return. You can track your numbers, produce a profit and loss statement and have the figures ready for your annual self-assessment tax return.

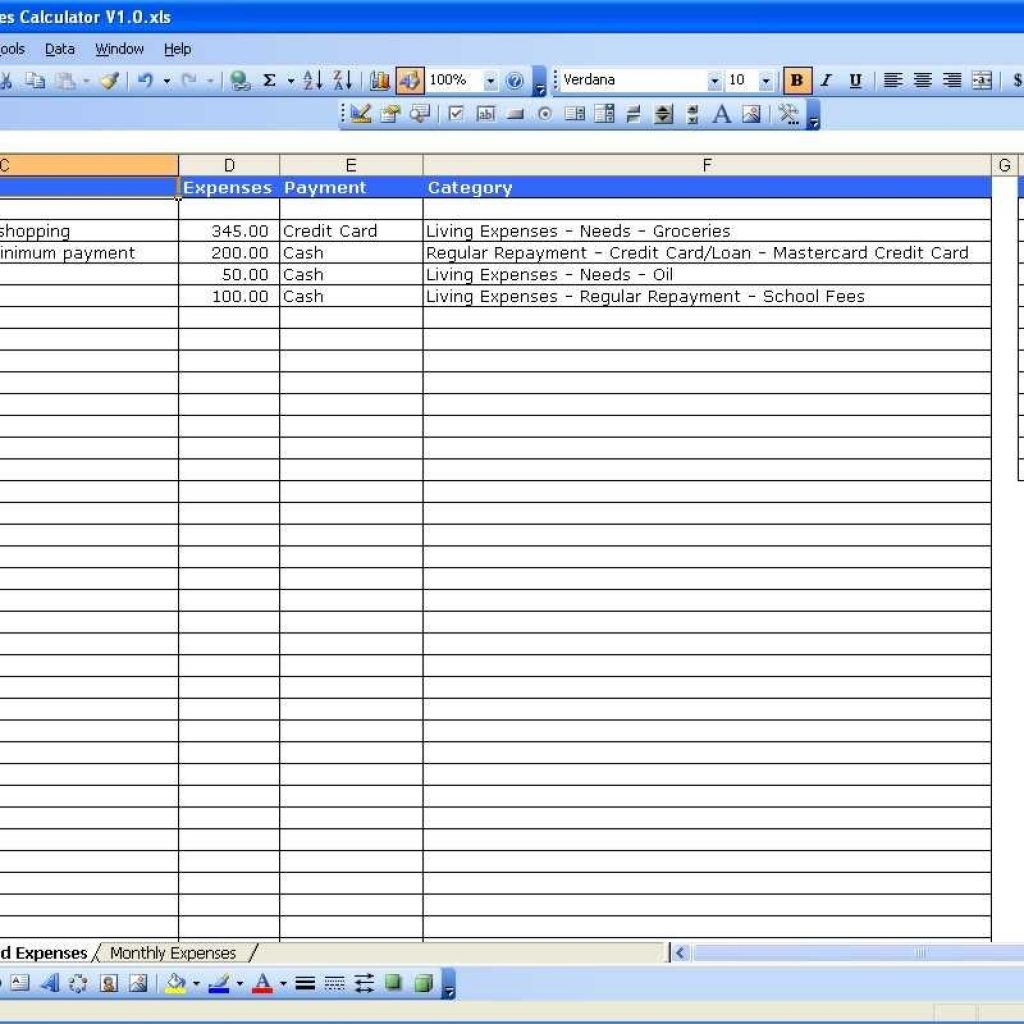

This is a simple, one year, business income and expenditure tracker for freelancers and sole traders, under the VAT threshold, and using the financial year as an accounting year. If your accounting needs are quite simple – and you want to make the job of organising your invoices and receipts in to a profit and loss statement, and having the right numbers for the right boxes on the self-employment tax return, super duper easy – then you need to have a copy! You can be sure that the formulas are correct and that once you’ve given each expense a category your numbers are ready to use. So I’m making it available to you, because I know it will save you loads of time compared to setting everything up from scratch. It’s the same one I use when I help my clients but of course I can’t prepare everyone’s tax return for them. WELL I HAVE A SYSTEM FOR THAT, AND OF COURSE IT’S A SPREADSHEET! ⭐ You’re going to need to put them in to some kind of organisation so you can pull out the right numbers.

It’s that time of year again, time to fill in your tax returnĪnd now you realise that all those receipts and documents, that you’ve been promising yourself you’d sort out all year, are still in a carrier bag, still in your “in” tray, or screwed up at the bottom of your bag.

0 kommentar(er)

0 kommentar(er)